By supporting a specific credit, investors have the unique ability to spur social change in a particular sector.

Learn more about the credits offered

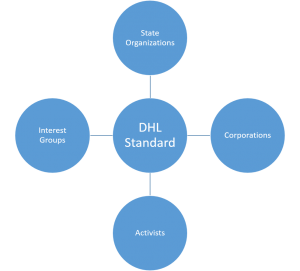

As a donations champion, you have the opportunity to profit from the DHL standard. In the current SREC market, credits are generally aggregated and sold as redeemable coupons to polluting companies. Correspondingly, E2F2 will define the protocols to underlay other types of efficiency credits, allowing them to be aggregated and sold off to similar companies that have an interest in promoting a specific type of environmental sustainability.

As a donations champion, you have the opportunity to profit from the DHL standard. In the current SREC market, credits are generally aggregated and sold as redeemable coupons to polluting companies. Correspondingly, E2F2 will define the protocols to underlay other types of efficiency credits, allowing them to be aggregated and sold off to similar companies that have an interest in promoting a specific type of environmental sustainability.

Thus, we will create a market in which homeowners can redeem their credit for the going market price, which will gradually garner mass traction as the public realizes the monetization potential of their green actions. By helping us facilitate the adoption of our system, investors have the opportunity to promote widespread social change and improve public health and the overall environment.

Investor Types

By supporting different types of credits, investors can drive specific macro trends to promote overall sustainability.

Efficiency Investors

Efficiency Investors

By supporting efficiency credits, investors can mitigate unnecessary electricity and resource expenditure and promote greener homes and communities.

Home Public Health Investors

Home Public Health Investors

As the government continues to mandate businesses to become greener, supporting Home Energy Credits will become an increasingly more attractive option. Home Energy Credit investors will be able to reduce the pollution and consumption of modern buildings.

Personal Health Investors

Personal Health Investors

By supporting health credits, investors have the opportunity to facilitate healthy dieting and reduce meat consumption.

Commuting Investors

Commuting Investors

By supporting automotive credits, investors can play a key role in mitigating harmful emissions. By demonstrating a positive change, investors can mitigate some of the standards imposed by regulatory organizations while contributing to the common good.

Social Investors

Social Investors

Social Credit investors will have the unique opportunity to promote social good within communities, contributing to less polluted and more sustainable environments.

Prior Success

Prior Success

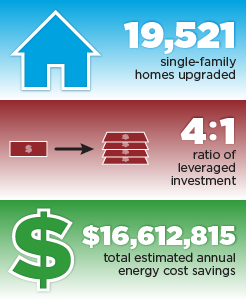

A case study documenting the success of such a project is the New York State Energy Research and Development Authority (NYSERDA) is a public benefit corporation that has been helping residents upgrade homes in New York state for more than 10 years. Tasked with protecting the environment and creating clean energy jobs, NYSERDA is working to reduce energy consumption and greenhouse gas emissions in alignment with New York’s ambitious goal of meeting 45% of statewide electricity use through renewable energy.

NYSERDA used $40 million in seed funding from the U.S. Department of Energy’s Better Buildings Neighborhood Program to create new, innovative financing mechanisms and bolster existing clean energy programs across the state.